Q&A: UCDA MD Reveals How The Authority Intends To Make Uganda Coffee More Competitive, Profitable

n an exclusive Q&A interview, Dr. Emmanuel Iyamulemye, the Managing Director of Uganda Coffee Development Authority (UCDA) responded to a wide range of issues concerning the coffee sub-sector and revealed plans to make Uganda coffee more competitive and profitable.

Q: UCDA has registered several achievements over the last five years under your leadership. What would you say are the major achievements for the coffee sub sector in this period?

A: As you have said, the Authority under my leadership has achieved a lot in the last five years. I must say it has been a team effort.

When I joined UCDA in 2016, there was a target of increasing coffee production to 20 million 60kg bags by 2025. I can report that we have seen coffee production increase from 4.2 million 60kg bags in FY 2015/16 to 8.06 million bags in FY 2020/21 while coffee exports have increased from 3.6 million 60kg bags in FY 2015/16 to 6.1 million 60kg bags in FY 2020/21. That’s no mean achievement for the industry. The coffee production and export figures recorded in FY 2020/21 were the highest ever. This is mainly attributed to the planting of new coffee trees. Cumulatively, 1.167bn coffee seedlings were generated and distributed between FY 2015/16 and FY 2020/21.

I thank the President for consistently encouraging people to plant coffee to improve household incomes.

To ensure that only quality coffee is produced, UCDA continuously sensitizes nursery operators. We developed for them training manuals on how to produce quality seedlings and this has greatly increased coffee production countrywide. Our target is to have at least one certified nursery operator in every sub-county to make seedlings more easily available to farmers.

UCDA is working with National Coffee Research Institute (NaCORI) to develop high-yielding and wilt-resistant coffee varieties.

To date, 10 varieties (KR1-10) have been developed and more are in the pipeline. We now have new Arabica varieties as well that are drought tolerant and high yielding.

Over the past five years, We have been sensitizing the public on the profitability of coffee as a business. For example, with a one hectare farm (approximately 2.5 acres of coffee), one can make a minimum of Shs20m annually which would change the fortunes of a household.

We have also established strategic partnerships with cultural institutions, religious institutions, district local governments, Uganda Development Bank and Uganda Prisons Services. We also revamped the International Women’s Coffee Alliance – Uganda Chapter to get more women in coffee because they are key in households.

With regards to sustainable coffee production, we have built capacity among the youth to trade brew and roast coffee.

We are now running a campaign on the rehabilitation of old coffee trees to increase production and productivity. To encourage farmers to stump their coffee trees, we have given them fertilizers but this is a one-off intervention to demonstrate how stumped coffee trees can be productive.

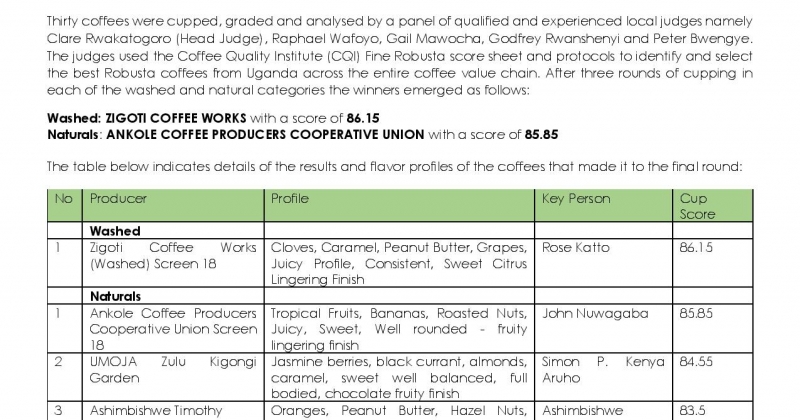

We have also promoted Uganda coffee in new markets. For example, we set up a coffee promotion office in Guangzhou, China in 2016 and since that time we have developed a coffee promotion strategy specifically for China. This is important for us because coffee consumption in China is growing at 15% annually compared to the global average of 2.5%. In addition, we partnered with the British High Commission to help Uganda Coffee enter the UK market. We have partnerships with Uganda’s foreign missions with commercial attachés. We want to maintain our key markets specifically Italy, Germany and Spain but we also want to go beyond. We want to embark on aggressive marketing. We have partnered with the Coffee Quality Institute (CQI) of the United States to develop the various profiles of coffee from different parts of Uganda because each region has its own unique taste.

The National Coffee Act 2021 is a landmark achievement for us. When UCDA was established in 1991, our mandate was on quality at pre-export but the new law allows us to regulate and promote quality of all on-farm and off-farm activities along the coffee value chain.

Q: The National Coffee Act has been hailed as a game changer. What are UCDA’s focus areas in as far as implementation of the law is concerned?

A: This Act gives UCDA powers to regulate all on-farm and off-farm activities in the coffee value chain.

The Act repealed the UCDA Act, Cap. 325, which was enacted in 1991 and only covered off-farm activities of marketing and processing, leaving on-farm activities like planting materials, nurseries, harvesting and post-harvest handling outside the scope of the law. We are right now focusing on sensitization of coffee stakeholders about this new law ahead of registration of farmers because once we have a farmer’s register, we shall have a traceability system that will make it easy to link farmers to the markets. It will also be easy for us to disseminate information to them. It also helps us in our planning; to know the number of old coffee trees and the pests and diseases that are prevalent in various areas.

We started by recruiting Parish Coffee Development Advisors. We are identifying lead farmers in parishes who will help in the registration of farmers once we have a platform that will capture all key variables about farmers.

Farmer organizations are also a key focus area for us. We have an MOU with Uganda Cooperative Alliance to professionalize cooperatives and farmer organizations. Picking from the Coffee Roadmap, our target is to grow coffee farmers in cooperatives from about 25% to 85%. We want to understand the needs of the existing farmer organisations and support smallholder farmers to get organized.

Q: What should coffee stakeholders (nursery operators, farmers, traders, exporters, café owners, processors, factory owners, roasters) expect from the Authority in the next five years?

A: We are focusing on agro-processing. With support from Government, we want to have a soluble plant in the next five years through a public-private partnership. We are working with Uganda Development Corporation to ensure that this is achieved. This will increase value addition to our coffee.

It would also be good if we established a packaging plant in Uganda because most of the packaging materials come from China and Kenya. The plant may not be exclusive to coffee but can serve other industries.

We are also positioning ourselves as producers of specialty and fine coffees. With high-quality/premium coffee, our coffee will market itself and fetch higher prices.

Q: There are concerns that farmers aren’t benefiting much from the increasing coffee exports. There are arguments that middlemen and largely foreign-owned companies are the ones benefiting at the expense of farmers. What are your thoughts about these concerns? How best can farmers get better prices?

A: Incidentally, there are many countries coming to benchmark on Uganda. The money that goes to the farmer is about 75% of the export price. The rest is divided among the middleman, the transporter and the exporter. However, we shouldn’t be celebrating about that price of green coffee. Our focus should be to have a big chunk of coffee exported as roast and ground coffee. That’s where the money is.

Q: What else is UCDA doing to promote coffee value addition across the coffee value chain?

A: Value addition is broad. Even quality is value addition; if you harvest ripe cherries and dry it well on tarpaulins or raised trellis, you are adding value to your coffee. The price you’ll get will be higher. We want more farmers selling Fair Average Quality coffee (kase) rather than kiboko (dry cherries). This can be achieved if milling the coffee is done at a subsidized cost and this is a process we are working on.

We have stepped up our efforts in coffee extension and training to advise farmers on the best practices to produce, harvest and process their coffee and add value to it.

At the tertiary level, we have procured wet mills to support small and medium farmers to process their Arabica coffee into parchment which fetches higher prices than red cherries. We also are building roasting and brewing capacity.

Q: UCDA has been promoting domestic coffee consumption over the past 10 or so years? What progress have you made? What plans do you have to increase consumption?

A: We have made good progress in coffee consumption. We have generally been a tea drinking country but that’s changing. Many people are appreciating the health benefits of drinking coffee. There’s a big mindset change. We are demystifying misconceptions that associate coffee with bad health. We have also trained youth in roasting and barista skills. There are so many coffee shops in every corner of Kampala and other upcountry cities and towns. We have now procured a promotional van. It’s under fabrication, fitting in brewing machines. It will be a moving kitchen and it will help us sensitive people on how to brew and drink coffee for health benefits. We also want to ensure that the baristas we have trained end up in cafes not roasteries. Young people are appreciating coffee drinking. We now have coffee clubs in most public universities.

Q: Farmers are facing many challenges including the Black Coffee Twig Borer and climate change among others. How do you intend to support them going forward?

A: It is true we received reports from farmers that some of their coffee trees were drying. In partnership with NaCORI, we carried out a study to establish the cause. We discovered that some of the trees had been attacked by the Coffee Wilt Disease and others by the Black Coffee Twig Borer. We are now trying to establish the magnitude of the problem as we plan to massively sensitize farmers on how to handle the challenge at hand. We are also looking at how Government can support farmers by, for example, waiving some taxes on key imported chemicals or providing the required chemicals to farmers at subsidized rates. We will also engage financial institutions to consider developing some input packages including fertilizers and affordable irrigation packages.